This guide explains how to configure payroll calculation rules and set up detailed compensation structures for team members using the Altegio payroll automation system within the new interface.

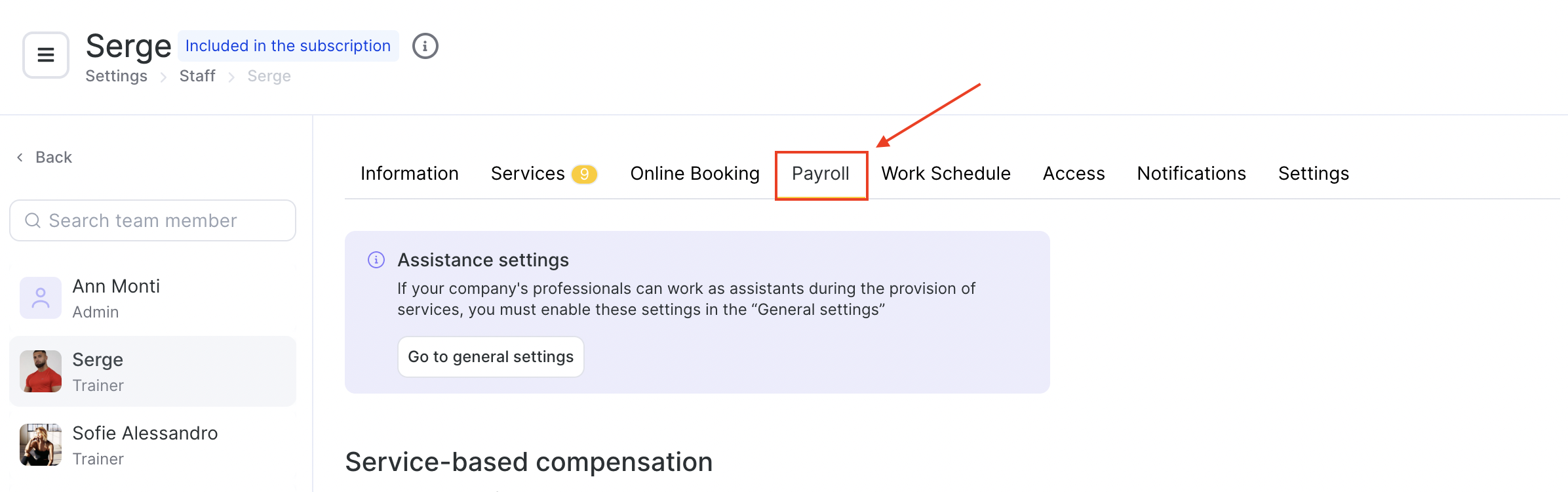

Step 1: Access the Payroll Configuration #

Navigate to the Payroll tab under a team member’s profile. To do so go to Settings >Team and click to select team member name. You will be redirected to team member personal profile that contains various tab for configuration. Proceed to the Payroll tab.

Enter the payroll rule setup screen. This is where you define how compensation is calculated based on services, assistance, shifts, sales, and other parameters.

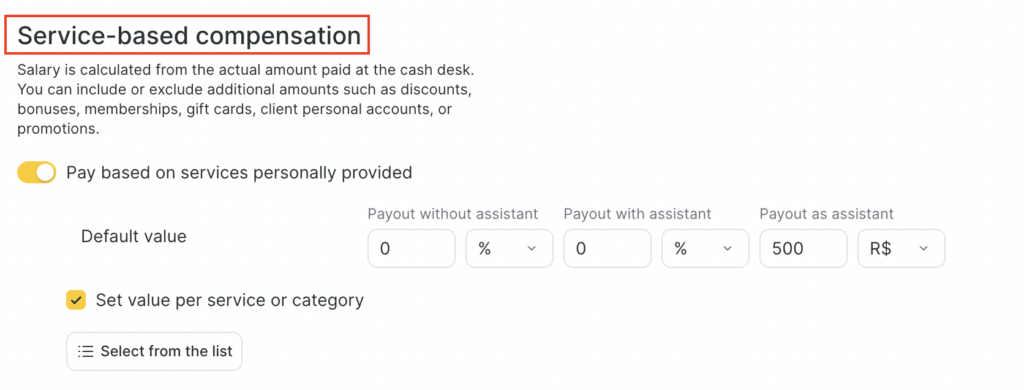

Service-Based Compensation #

This section allows you to set how a team member is paid for services they personally performed or assisted with. The salary is calculated based on the actual amount the client paid at the cash desk. You can choose whether additional amounts (such as discounts, bonuses, memberships, gift cards, client account funds, or promotions) are included in the calculation.

Enable the “Pay based on services personally provided” option if you want the team member to receive compensation for participating in services.

When this setting is active, you can define three payout types:

Payout without assistant

Compensation when the team member performs the service alone, without any assistants.

Payout with assistant

Compensation when the team member performs the service as the main provider, but with one or more assistants involved.

Payout as assistant

Compensation when the team member participates in a service only as an assistant.

How to Set the Payout Values #

In each field, enter how the salary should be calculated for that scenario. You can choose:

- Percentage (%) — The team member receives a percentage of the service price.

- Fixed amount — The team member receives a fixed monetary amount per service.

For example:

- Payout without assistant: 10%

- Payout with assistant: 8%

- Payout as assistant: 5 R$

This means:

- If the team member performs the service alone, they receive 10% of the cost.

- If they are the main provider but with an assistant, they receive 8%.

- If they assist another provider, they receive a fixed 5 R$.

Read more about assistance settings in this article below.

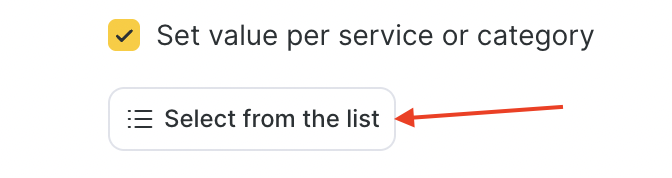

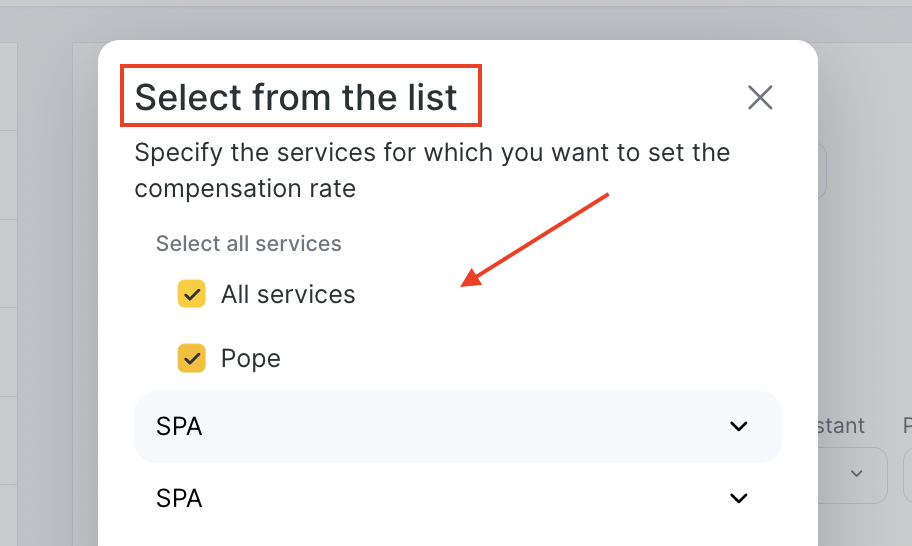

Set value per service or category – to specify different payouts for particular services or categories.

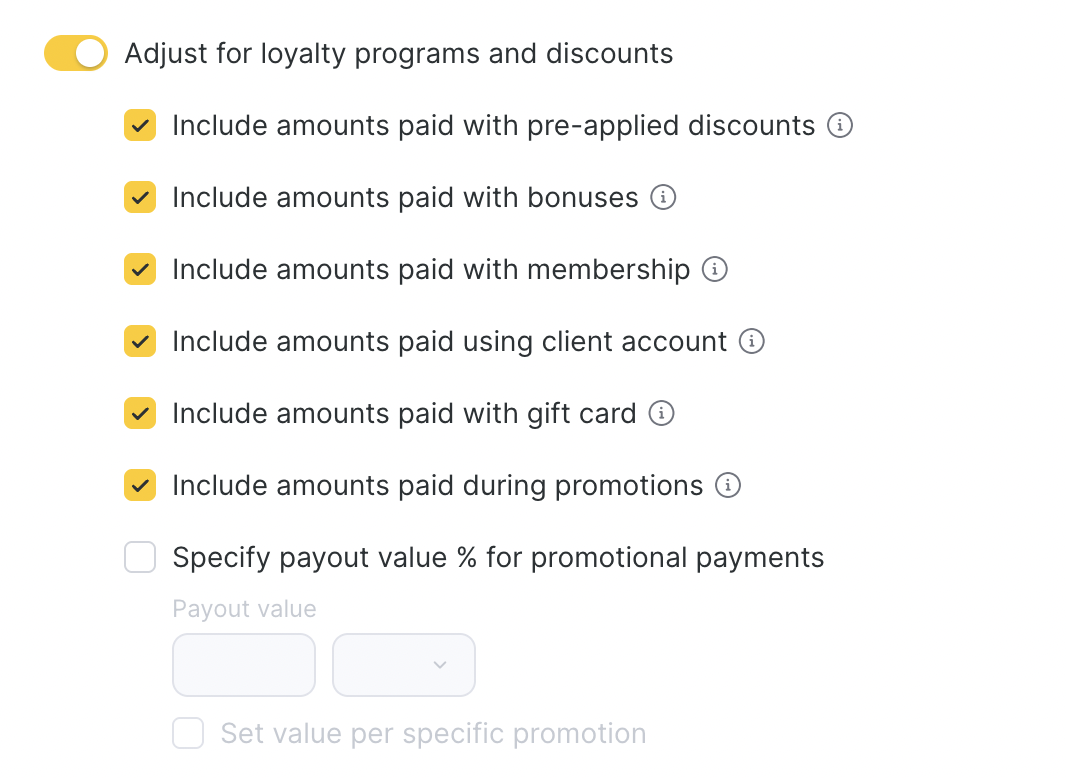

Adjust for loyalty programs and discounts – choose whether to include discounts, bonuses, memberships, gift cards, or promotional payments. You can also specify a special % for promotional sales.

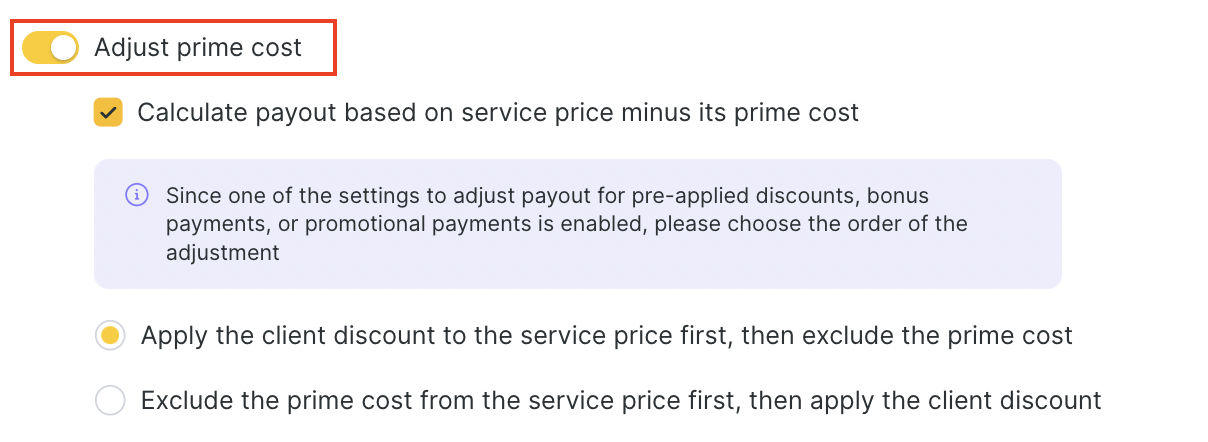

Adjust prime cost – calculate payouts based on service price minus its prime cost.

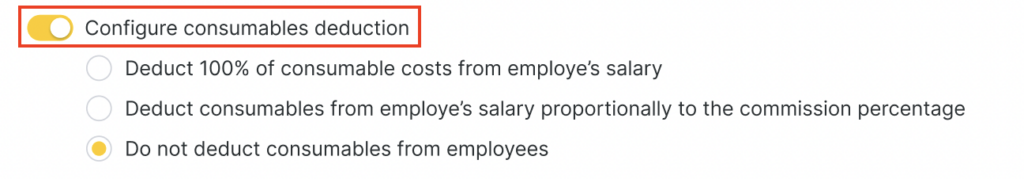

Configure consumables deduction – configure how the cost of consumables affects a team member’s salary for services that use resources (color, materials, etc.).

Choose one of the following options:

- Deduct 100% of consumable costs from team member’s salary

The full consumables cost for the visit is deducted from the calculated salary. - Deduct consumables from team member’s salary proportionally to the commission percentage

Only a part of the consumables cost is deducted. The system multiplies the total consumables cost by the team member’s commission percentage and deducts this amount from their salary. The remaining cost is covered by the company. - Do not deduct consumables from team members

Consumables are not deducted from the team member’s salary. The company fully covers these costs.

Note. If the Apply discount to consumables option is enabled in the discount settings, the cost of consumables is reduced in the same proportion as the discount before it is deducted from the team member’s salary.

Example: fixed discount and consumables #

Below is an example of how the system calculates salary when a fixed discount and consumables deduction are applied. Currency is shown as “$” for simplicity.

Input data

- Service price: 1,500 $

- Fixed discount (promo): 100 $ → the client pays 1,400 $

- Team member’s commission: 40% of the final amount (without assistant)

- Consumables cost: 100 $

- Settings:

- Deduct 100% of consumable costs from team member’s salary

- Apply discount to consumables — ON

Calculation

- Calculate the team member’s commission from the final amount:

1,400 × 0.40 = 560 $ - Calculate the discount coefficient:

1,400 / 1,500 = 0.9333 - Adjust the consumables cost by the discount coefficient (because Apply discount to consumables is ON):

100 × 0.9333 = 93.33 $ - Deduct the adjusted consumables cost from the team member’s commission:

560 − 93.33 = 466.67 $

Result: the team member’s salary for this appointment will be 466.67 $.

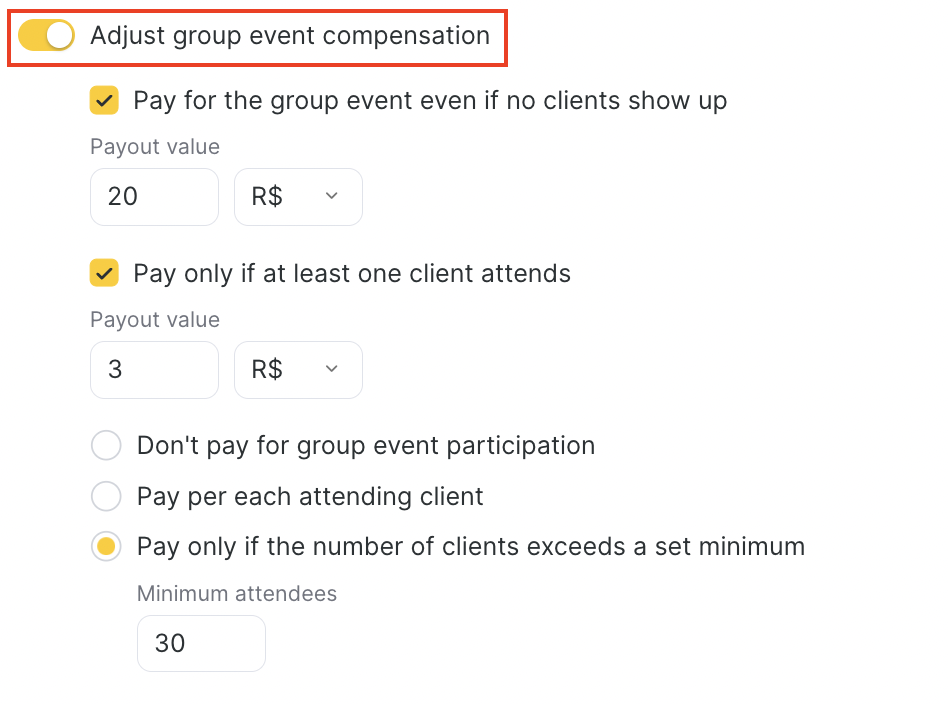

Group event compensation – flexible rules for services provided in group settings.

Examples #

1. Pay only if clients attend

- Setting: Pay only if at least one client attends.

- Example: Team member gets 0 if no one comes, but if at least 1 client attends, they receive 20 R$ fixed.

2. Pay percentage for event (not per person)

- Setting: Pay only if at least one client attends + % payout.

- Example: Team member gets 50% of the service price if at least 1 person attends (not multiplied by the number of participants).

3. Extra per participant

- Setting: Additional compensation per each client + “If number of clients exceeds = 0”.

- Example: Team member gets 60% of service price per each client. With 7 clients, the reward is 7 × 60% of the visit price.

4. Base compensation even if no clients

- Setting: Base compensation (no clients required).

- Example:

- 0 participants → team member still receives 5% of service price.

- Each participant adds 60% of visit price.

5. Threshold + extra per client

- Setting: Pay if at least one client attends + extra per client above threshold.

- Example:

- 1–10 participants → team member gets 60% of service card price.

- 11+ participants → they also get 15% extra per client above 10.

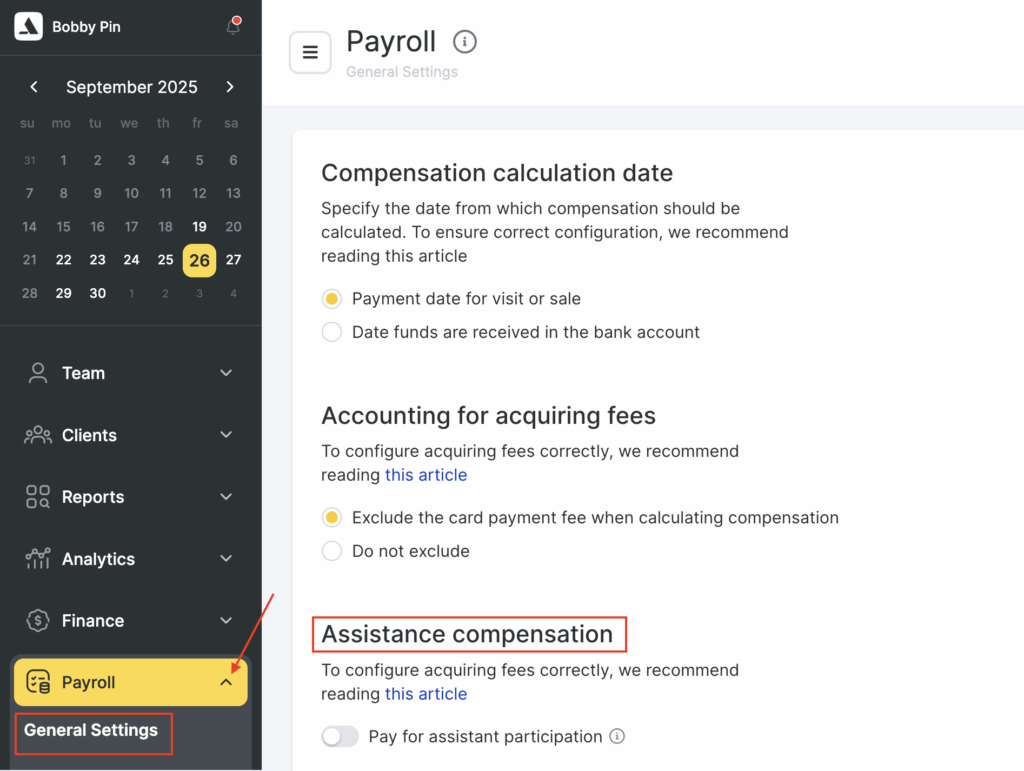

Enable Assistant Compensation #

Go to Settings > Payroll > General Settings and enable the option:

Pay for assisting in service delivery

This unlocks compensation tracking for assistants involved in appointments.

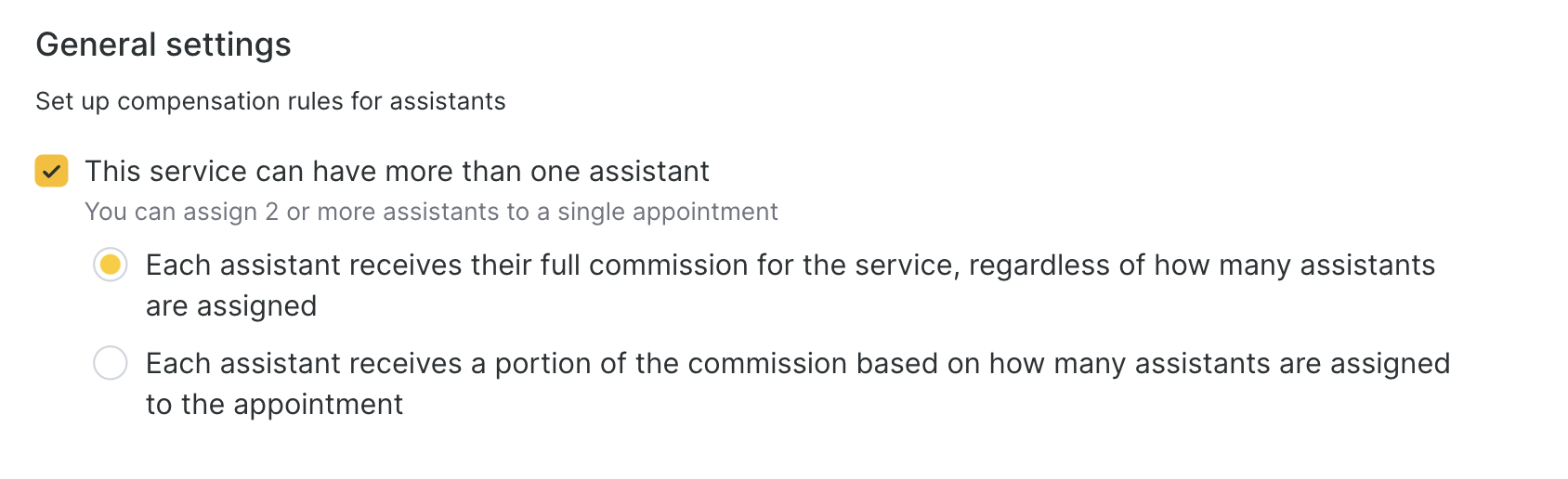

You also need to set the commission logic for services involving multiple professionals:

Each assistant can receive their full commission (regardless of the number of assistants), or

Commission can be shared between assistants.

Add Assistants in Appointment Window #

During appointment or at the time of service, you can add assistants to the appointment. To do this:

Make sure your team member’s role has permission to add/edit assistants in the appointment window. Open the appointment and use the Assistant section to add team members.

Tooltips will guide users if permission is missing (e.g., “You do not have permission to add assistants. Contact your management…”)

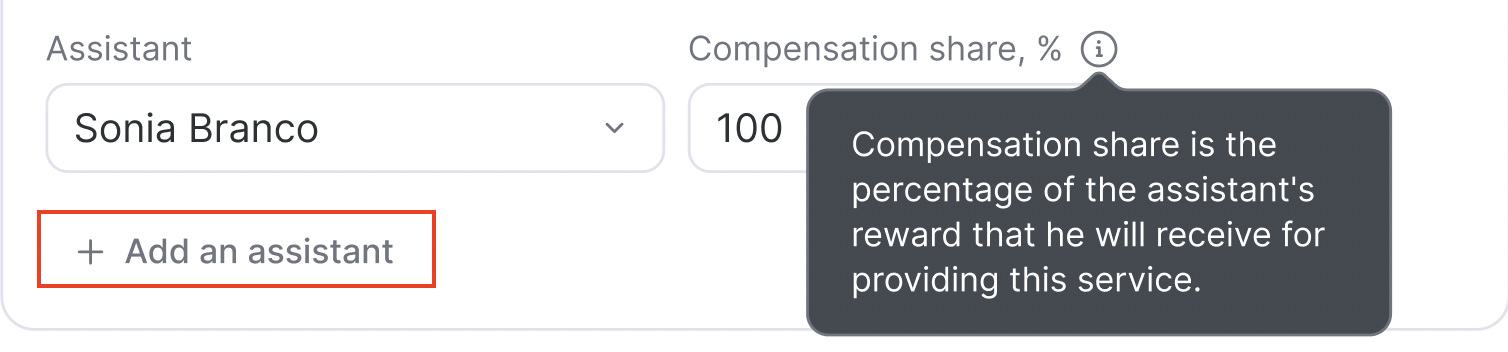

Configure Assistant Shares (Optional)

By default, when multiple assistants are added to a service, the system splits the compensation share equally (e.g., 50% each for two assistants).

If your settings allow it, you can manually adjust compensation shares:

•Toggle ON “Work may not be distributed equally” to enable manual entry.

•Enter custom percentages for each assistant.Tooltip explains: “Compensation share is the percentage of the assistant’s reward that they will receive for providing this service.”

How Compensation is Calculated

For Assistants:

Assistant’s pay = (“As assistant” rate) × (compensation share %)

For Main team member:

If “With assistants” rate is set: team member receives that amount.

If team member is also listed as an assistant in the same service, they will receive both their “With assistants” and “As assistant” compensation.

If “With assistants” is blank: team member’s compensation = “Without assistants” rate − total assistants’ compensation

Example:

- “Without assistants” = 50%

- “As assistant” = 10% for each assistant

- Assistant 1 share = 50%, Assistant 2 share = 40%

- Team member commission = 50% – (10% + 10%) = 30%

Enabling assistant compensation helps you:

- Reward all team members involved in service delivery

- Optimize workload distribution

- Manage payroll transparently

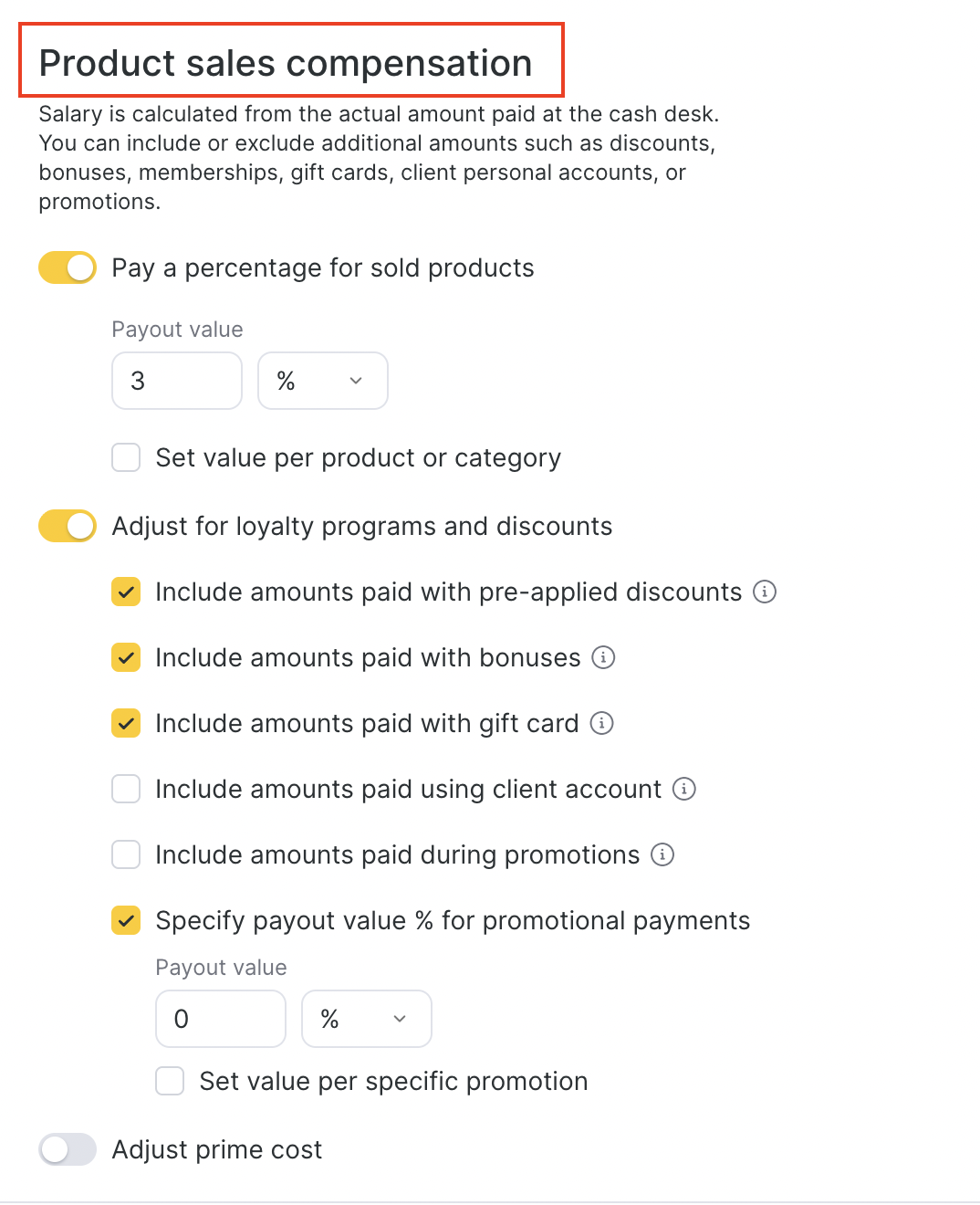

Product Sales Compensation #

Here you can reward team members for product sales.

You can configure:

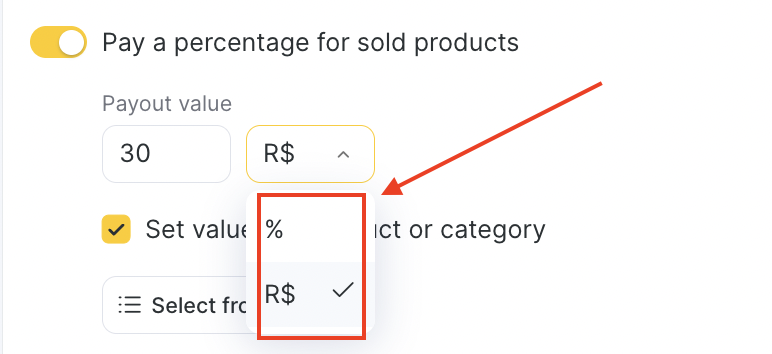

Payout value – a fixed percentage or currency from product sales.

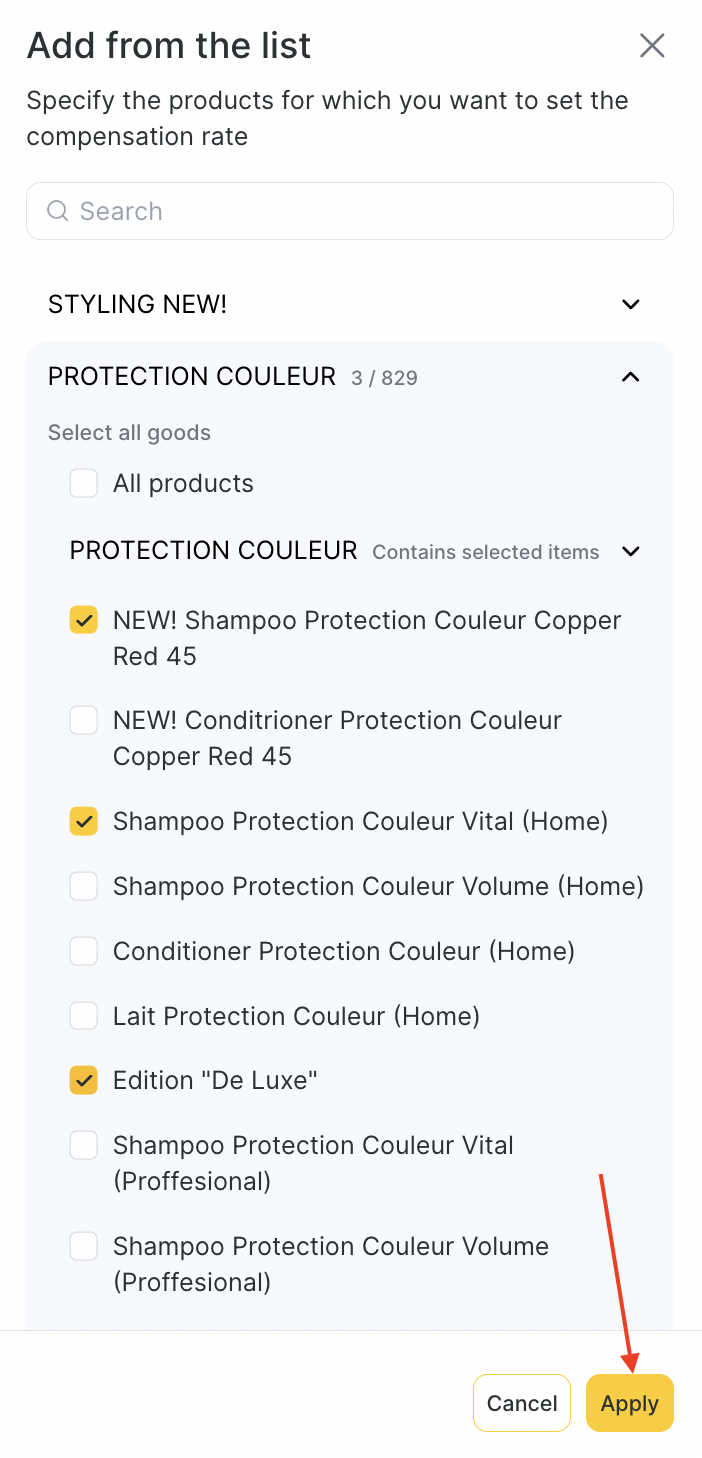

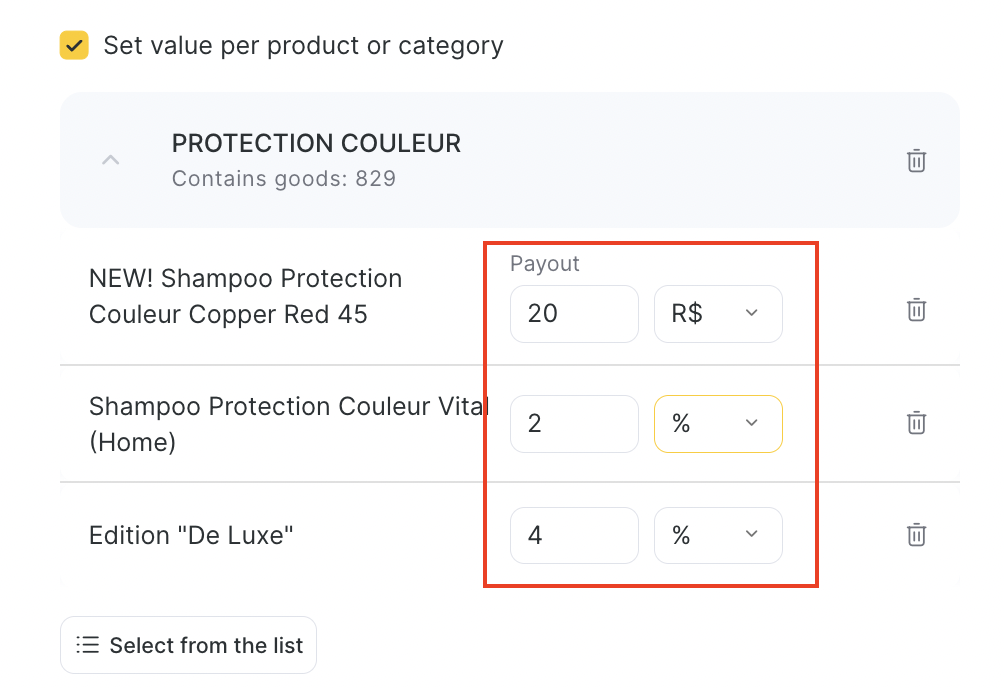

Set value per product or category – assign different percentages for specific products.

Once you click Apply, the modal will collapse and you can set different values to compensation from product sales.

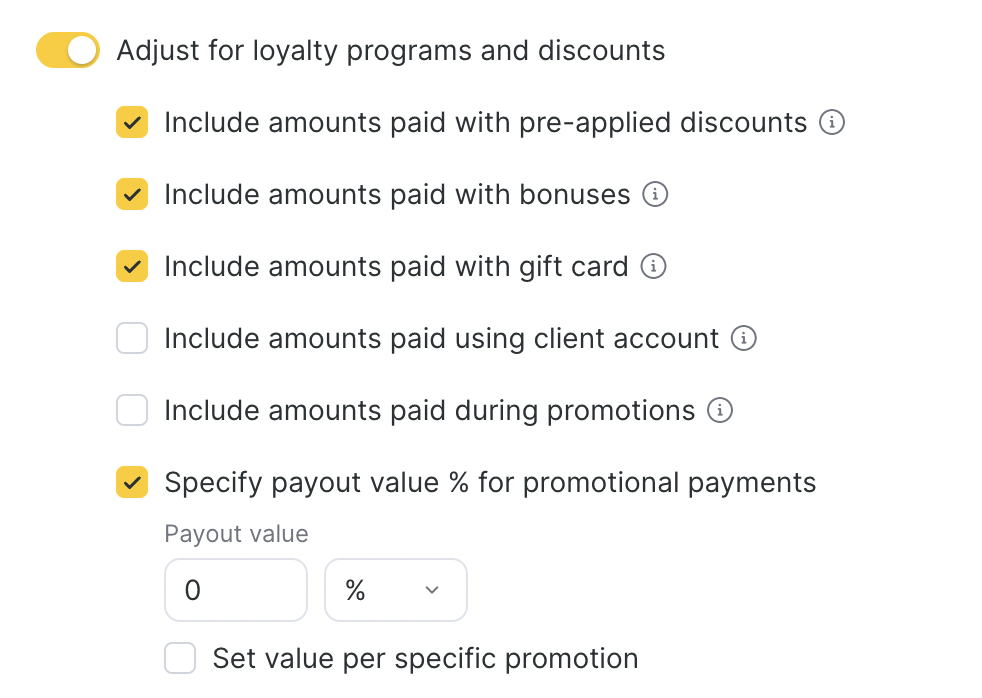

Adjust for loyalty programs and discounts – include certain payments or specify a lower % for promotional sales.

Adjust prime cost – calculate payout from product price minus prime cost.

Calculation Formula for Services and Products #

When you want to apply a different promotional payout % (PP) to the loyalty/discount portion, check the “Specify payout value % for promotional payments” box.

If it’s not enabled, the system will just calculate everything using the standard payout % (SP).

For services:

If the box is checked:

(SC – LP) × SP + LP × PP

If the box is not checked:

SC × SP + LP × PP

Where:

- SC = service cost

- LP = sum paid with loyalty/discount

- SP = service payout % in the rule

- PP = promotional payout % in the rule

For products:

If the box is checked:

(PC – LP) × SP + LP × PP

If the box is not checked:

PC × SP + LP × PP

Where:

- PC = product cost

- LP = sum paid with loyalty/discount

- SP = product payout % in the rule

- PP = promotional payout % in the rule

General Principle #

The system splits the calculation into two parts:

- The main cost minus loyalty payment is multiplied by the standard payout %.

- The loyalty part (discount, bonus, membership, gift card, etc.) is multiplied by the promotional payout %.

- Both sums are added → final team member reward.

Example 1 — Promotions Included #

- Service cost (SC) = 1,600

- Rule (SP) = 50% of service price

- Loyalty discount (LP) = 80 (5%)

- Promotional payout % (PP) = 22%

- Checkbox = checked

Calculation:

(1,600 – 80) × 50% + 80 × 22%

= 1,520 × 50% + 80 × 22%

= 760 + 17.6

= 777.6 R$

Example 2 — Promotions Not Included #

- Service cost (SC) = 1,600

- Rule (SP) = 50% of service price

- Loyalty discount (LP) = 80 (5%)

- Promotional payout % (PP) = 22%

- Checkbox = not checked

Calculation:

1,600 × 50% + 80 × 22% = 800 + 17.6 = 817.6 R$

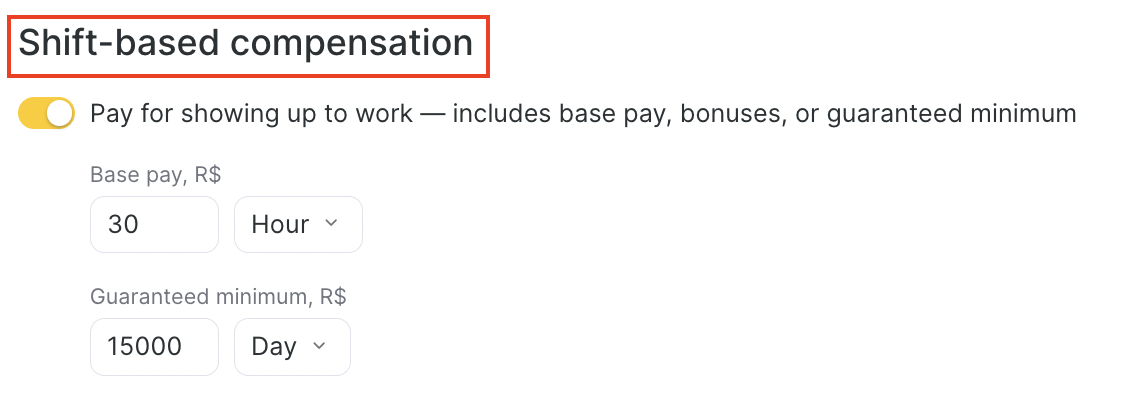

Shift-Based Compensation #

This rewards team members for showing up, regardless of sales or services.

You can set:

Base pay (per day, hour, or month).

Guaranteed minimum (per month).

Base Salary Rules

Fixed salary is paid on the first day of the following month.

→ Example: Salary for January is paid on February 1.

Team member must have at least 1 scheduled work hour/day in that month.

Payroll chart must be active for the team member during that month.

Example

If you set calculation period 1–30 September:

- August salary will be paid (if conditions are met).

- September salary will not be paid yet.

If you set calculation period 2 September – 1 October:

September salary will be paid (since the 1st of October is included).

August salary will not be paid.

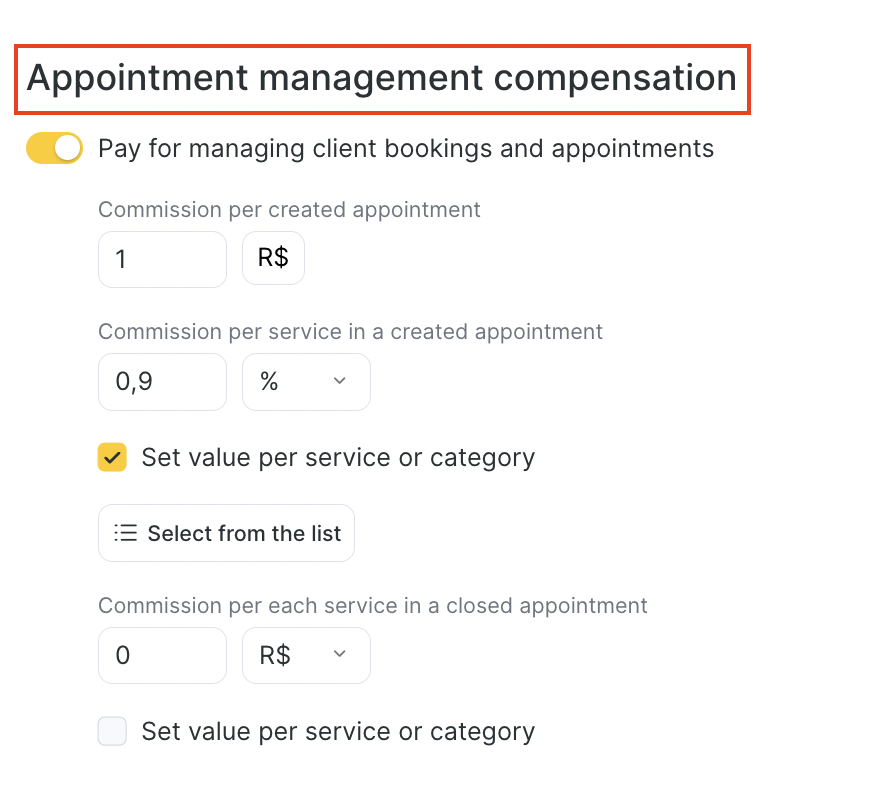

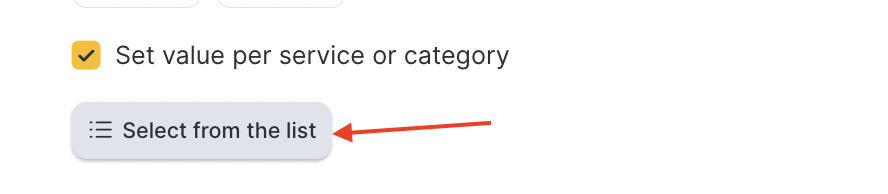

Appointment Management Compensation #

For receptionists who create and manage appointments.

- Commission per created appointment – fixed payout per booking created.

- Commission per service in a created appointment – payout per service added.

- Commission per service in a closed appointment – payout when appointment status is marked as Attended.

You can also set values per category/service.

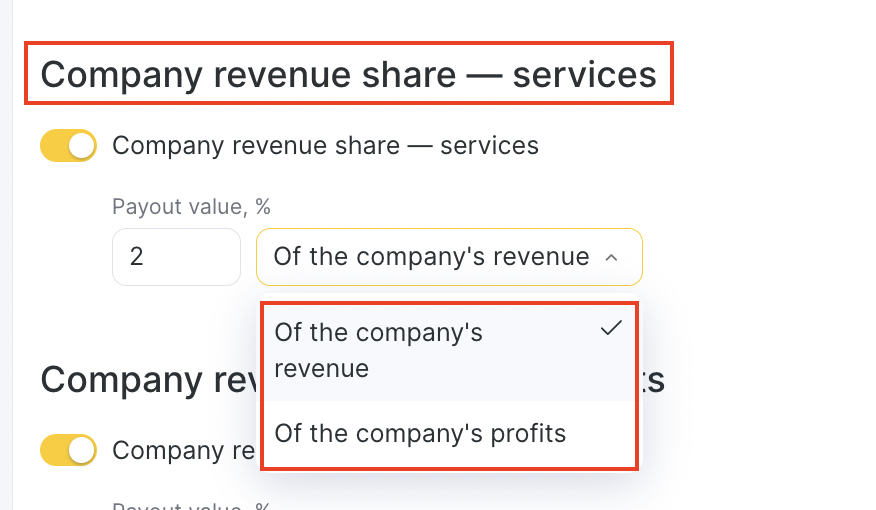

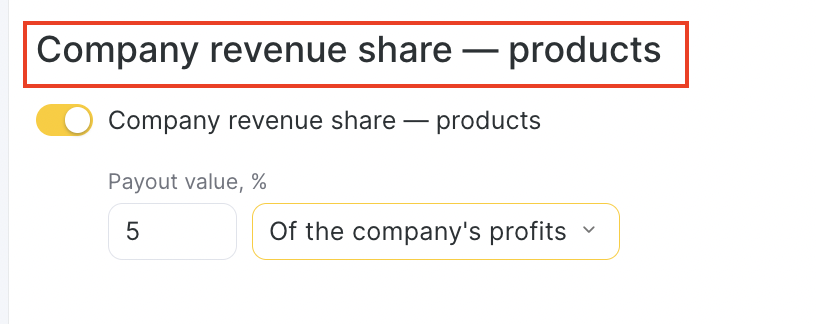

Company Revenue Share #

You can reward team members based on overall company results based on product sales or service provision.

A percentage of company’s revenue.

Or a percentage of company’s profit (for products).

percent of the daily sales or profit of the location for products and/or services. It’s often used in calculation rules for administrators.

Revenue – sum of services provided and products sold.

Profit – difference between sales and prime cost of services and products.