🇧🇷 This feature is available for Brazilian accounts only and works with the eNotas integration.

Overview #

To help Brazilian business owners avoid double taxation when clients pay using client account top-ups, gift cards, or loyalty balances, Altegio now supports flexible rules for issuing Nota Fiscal. You can now choose when the NF should be created based on your specific needs and tax setup.

Where to Find It #

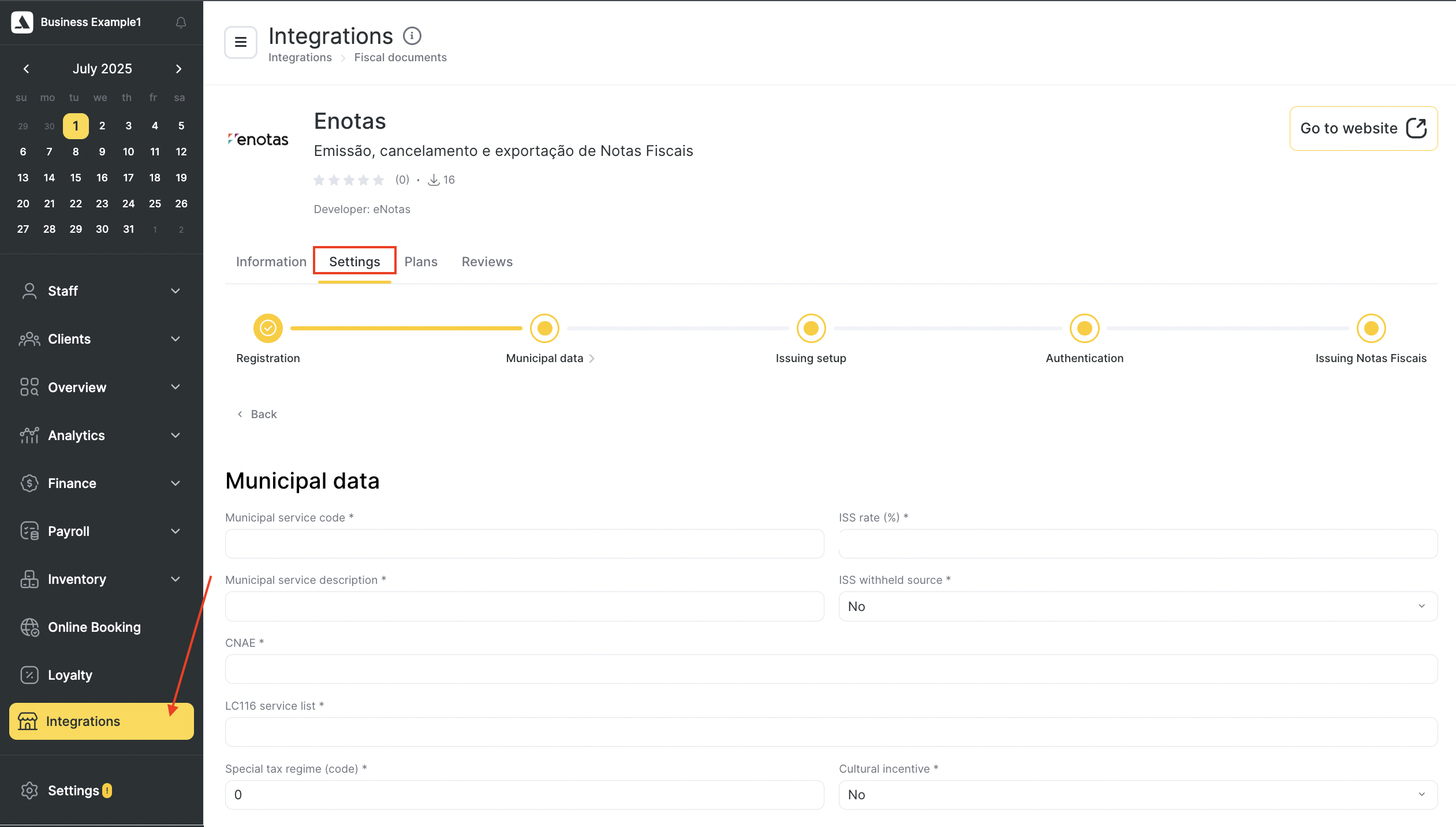

To configure your NF issuance rule:

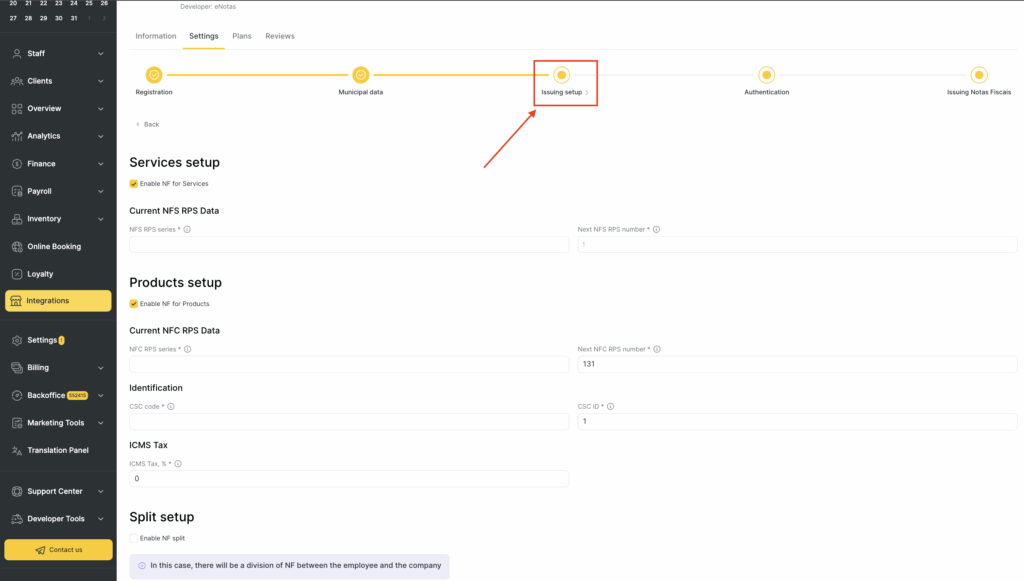

Go to Integrations → eNotas → Connect → Settings.

There, you’ll find the new section called Issuing setup. where you can configure the rules for your business.

Issuance Rule Options #

You can choose one of the following options:

Option 1 (Default): #

“I want to issue Nota Fiscal only after I performed service or sold a product/gift card/membership and my client paid for it”

With this rule:

- NF is created after the service is delivered or the product is sold.

- Top-up or gift card payments do not trigger NF issuance immediately.

- Helps avoid double taxation.

- Best suited if you use Lei do Salão Parceiro (Lei nº 13.352/2016).

Example:

Client prepays R$500 to their account → no NF issued at this stage.

Later, they book a R$300 service → NF is issued only for R$300.

Option 2: #

“I want to issue Nota Fiscal when I receive money from my client, even if I didn’t perform service or sell a product (e.g., client account top-ups or gift cards)”

With this rule:

- NF is created as soon as you receive the money — even if it’s a deposit, gift card, or loyalty credit.

- Ensures all income is documented up front.

- Useful if you want tax documentation for every incoming payment.

Examples:

- Client buys a R$500 gift card → NF is issued immediately for R$500.

- Later uses R$300 from the gift card to pay for a service → no NF is issued again (since it was already issued for the top-up).

What If a Service is Paid Partially with Loyalty or Credit? #

If the service is partially paid using account client account top-ups, gift cards, or loyalty, the NF will only cover the unpaid amount. For example:

- A R$300 service paid with R$200 from account balance → NF is issued for R$100 only.

Loyalty Payments and Split Logic #

When Enable NF split is turned on, Altegio will automatically:

- Apply Option 1 (NF issued only after service/product is delivered).

- Disable Option 2.

Recurring Memberships #

If you’re using Recurring Memberships, and Option 2 is active, then:

- NF will be automatically saved and issued for every recurrent payment.

How It Looks in the System #

If NF should not be saved for top-ups and gift cards: #

- You won’t see the “Issue Nota Fiscal” button during payment.

- “NF saved” message is also hidden after payment.

If NF should be saved (Option 2): #

- All received funds, including prepaid ones, will trigger NF creation.

- System calculates NF amounts by subtracting prepaid values used for services to prevent double-counting.

Best Practices #

- Use Option 1 if you follow Lei do Salão Parceiro or want to reduce tax base.

- Use Option 2 if you want all incoming money (including top-ups) to be documented immediately.

- Avoid enabling Option 2 if you plan to split payments using loyalty, to prevent tax over-reporting.

If you need help adjusting these settings, please reach out to Altegio support.